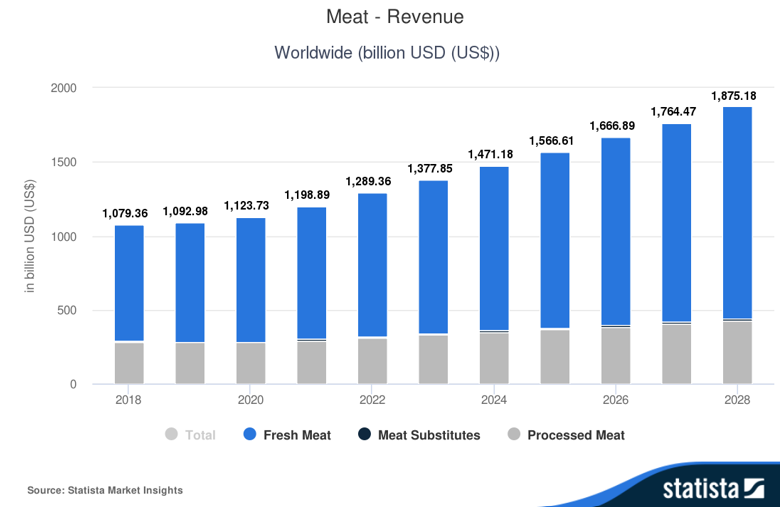

Market Overview – Global revenue projections

The global meat market is a massive industry that covers all products made from animals (like beef, pork, lamb, poultry, etc.) that is used for food and prepared through a specific process for consumption (i.e. cooked, salted, smoked, fermented, etc.). The meat products market altogether is currently valued at an estimate of $1.472 trillion in 2024 and is predicted to reach $1.875 trillion by 2028, at a compound annual growth rate (CAGR) of 6.24% from 2024 – 2028. According to Statista, the top 5 countries that generate the most revenue from meat products is China ($273B USD), The United States ($132B USD), Mexico ($57B USD), Russia ($53B USD), and France ($48B USD).

Key Trends

The meat products market is being impacted by numerous economic, environmental, and sociocultural related trends. There’s been a huge increase in demand because of a rise in the world’s population growth. According to the United Nations (UN), the world’s population is expected to reach 8.5 billion in 2030, and even be 9.7 billion in 2050.[1] This population increase combined with a rise in emerging markets (i.e. China, India, etc.) and the disposable income of people in these developing economies has led to a huge boost in meat consumption.

Furthermore, frequently changing tastes and shifts in preferences have changed the types of meat products consumers are attracted to. For instance, as urbanization has become more common, to accommodate the fast-paced, busy lifestyles of those who live in the city, convenient, processed items like ready-to-eat/pre-cooked meat products have gained popularity. In addition, there has been an increase in environmentally and health-conscious consumers with specific dietary lifestyles (i.e. vegan, vegetarian, etc.) and animal welfare related concerns. This demographic’s beliefs have led to increased interest in leaner cuts and plant-based or meat alternatives like tofu or “impossible” burgers. Now that consumers have more money to buy the things they want and need, they want better-quality meats that aren’t full of antibiotics and hormones but are also ethically and sustainably produced. This trend has fueled demand for premium/specialty meat options like organic, free-range, and grass-fed meat. Ultimately, this market is growing and is expected to continue growing rapidly as the trends work in its favor.

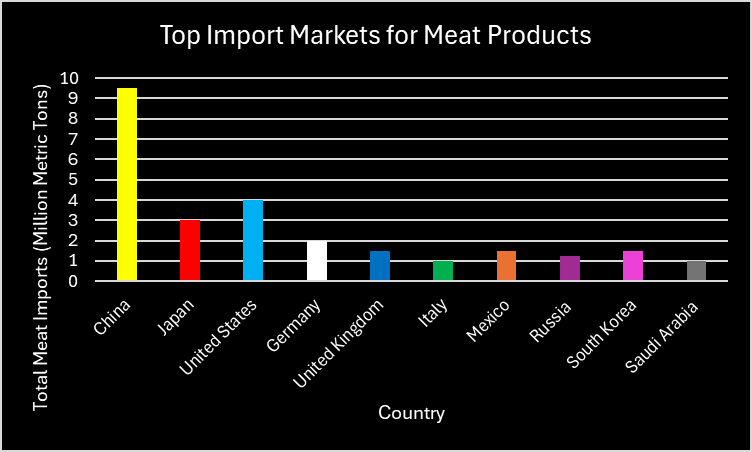

Top Import Markets

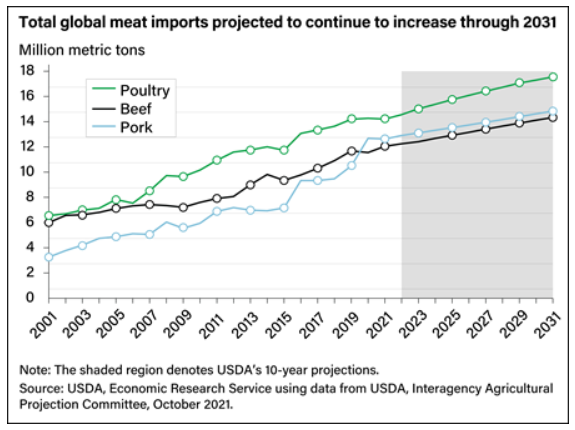

According to the ESS-Feed, the top 10 import markets for meat products, in million metric tons is China (9.5), the United States (4), Japan (3), Germany (2), the United Kingdom (1.5), Italy (1), Mexico (1.5), Russia (1.25), South Korea (1.5), and Saudi Arabia (1). By product segment, the USDA predicts that poultry imports will grow to 17.5 million metric tons, pork imports will grow to 14.8 million metric tons, and beef imports will rise to 14.3 million metric tons, all by 2031.

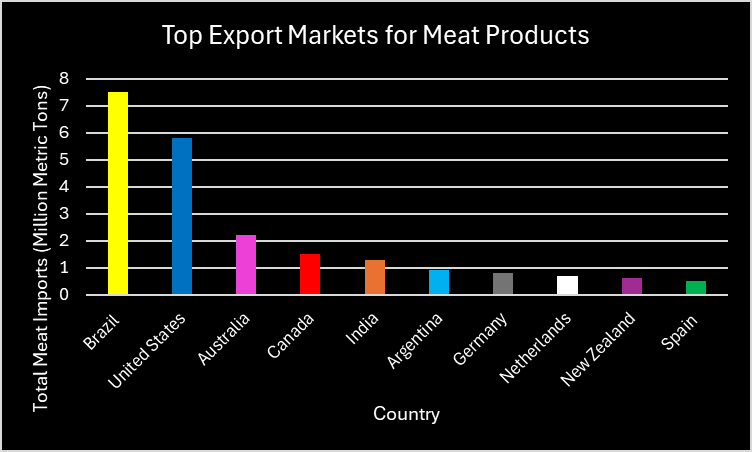

According to Geeks for Geeks, the top 10 meat exporting markets in million metric tons is Brazil (7.5), the United States (5.8), Australia (2.2), Canada (1.5), India (1.3), Argentina (0.9), Germany (0.8), Netherlands (0.7), New Zealand (0.6), and Spain (0.5). Like imports, the USDA predicts that poultry (chicken) exports will increase by over 15 percent while beef and pork exports will increase by less than 15 percent. Brazil is the largest exporter of beef while the United States is the largest exporter poultry, and the European Union is the largest exporter of pork. All things considered, global meat export and imports aren’t expected to slow down anytime soon. So, there’s a very positive outlook on the growth of this industry for the future.

US Market Growth Projections

As previously mentioned, the United States is the second largest country to receive the most revenue from the meat. In the US, the market is valued at $132.3B and is expected to grow annually at a CAGR of 4.39% from 2024 – 2028. According to the United States Department of Agriculture (USDA), in 2023, the average U.S citizen ate 227.3 pounds of meat per capita. Of this amount, from largest to smallest, Americans consumed chicken (101.6 pounds), beef (56.1), pork (52.4 pounds), turkey (15.8 pounds), lamb and mutton (1.3 pounds), and veal (.1 pounds). To put it in perspective, each major segment holds the following percentage of per capita meat consumption, chicken (45%), beef (25%), pork (23%), and turkey (.07%). All meat products, but especially chicken, in the U.S., are forecasted to grow in consumption and demand soon.