Global Market Overview

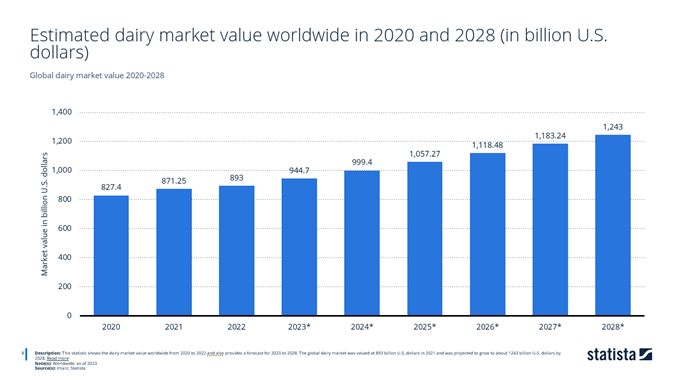

The global dairy market was valued at 893 billion U.S. dollars in 2022 and was projected to grow to about 1243 billion U.S. dollars by 2028. It is anticipated that the industry’s growth trajectory may ascend by approximately 40% over the span of six years. These statistics are indicative of significant expansion within the sector.

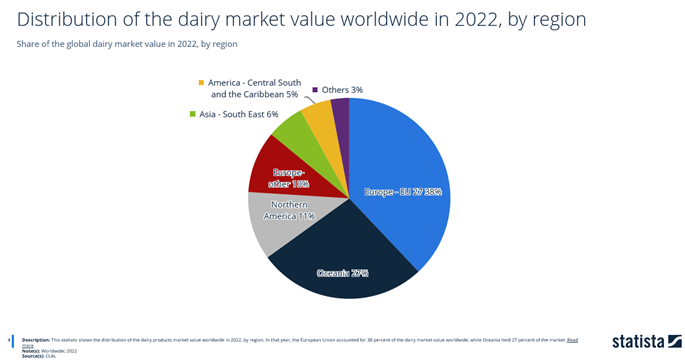

When it comes to the distribution of the dairy products market value worldwide in 2022, by region, the European Union accounted for 38 percent of the dairy market value worldwide, while Oceania held 27 percent of the market.

For an exporter of dairy products, the data suggests that targeting markets within the European Union and Oceania could offer significant opportunities due to their combined share of 65% of the global dairy market value in 2022, indicating strong demand and potential for market penetration and growth.

Key Trends

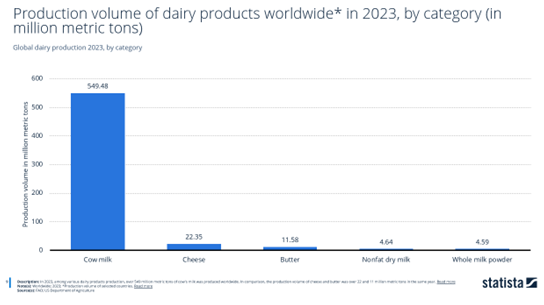

In 2023, among various dairy products production, over 549 million metric tons of cow’s milk was produced worldwide. In comparison, the production volume of cheese and butter was over 22 and 11 million metric tons in the same year.

This suggests that cow’s milk is a dominant and foundational component of the global dairy industry. For dairy product exporters, this underscores the importance and viability of focusing on milk-related products for export.

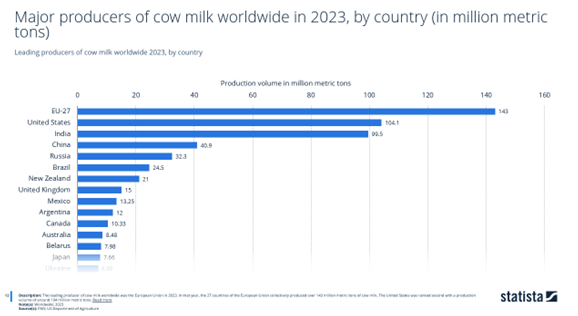

The European Union was the world’s top producer of cow milk in 2023. The 27 nations in the EU combined generated more than 143 million metric tonnes of cow milk in that year. With an estimated 104 million metric tonnes of output, the United States came in second.

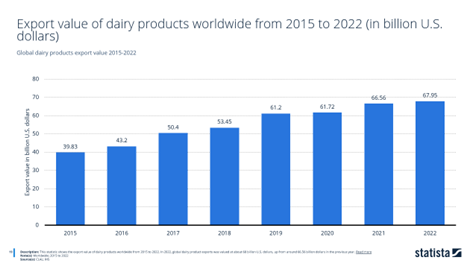

The export value of dairy products worldwide reached about 68 billion U.S. dollars in 2022, up from about 66 billion U.S. dollars in the previous year. As the top producer of cow milk worldwide, the European Union also was the top exporter of dairy products.

Cheese is the second biggest category in dairy products worldwide. The European Union had the highest per capita cheese consumption globally, followed by the United States and Canada. In 2021, per capita cheese consumption in the EU-27 reached 20.44 kilograms. France, well-known for its rich cheese culture, notably surpassed the EU average with a per capita consumption of 26.8 kilograms in 2019. Some popular French cheeses include Camembert, Brie, Comté, Roquefort, and Bleu d’Auvergne.

US Market Overview

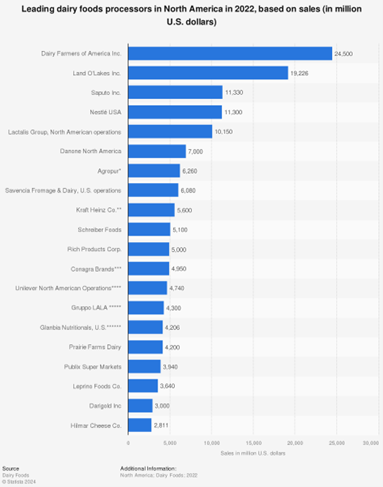

The Dairy Farmers of America, based in the United States, is the biggest player in the global dairy market, while New Zealand is home to the second-largest dairy production company, Fonterra. When it comes to dairy processing and dairy products, Land O’Lakes is the leading company in North America, generating just about 46 billion sales in U.S. dollars in 2021.

Export Analysis

In 2022, global dairy product exports was valued at about 68 billion U.S. dollars, up from around 66.56 billion dollars in the previous year.

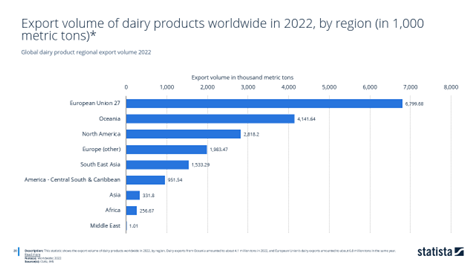

Dairy exports from Oceania amounted to about 4.1 million tons in 2022, and the European Union’s dairy exports amounted to about 6.8 million tons in the same year.

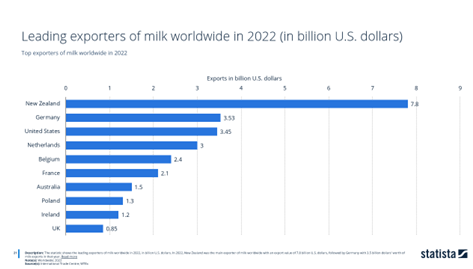

Milk, a prominent dairy product, has emerged as a key commodity in global exports. In 2022, New Zealand held the top position as the leading exporter of milk globally, boasting an export value of 7.8 billion U.S. dollars. Following closely behind was Germany, with milk exports totaling 3.5 billion dollars in the same year.

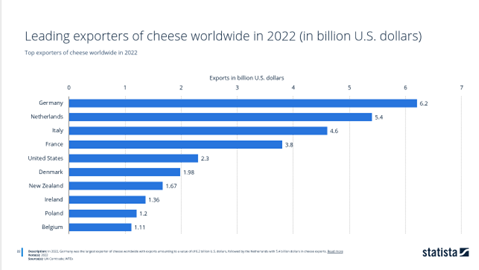

As for the cheese exporters, Germany was the top exporter in 2021 with 6.2 billion USD followed by the Netherlands (5.4 billion USD) and Italy (4.6 billion USD)

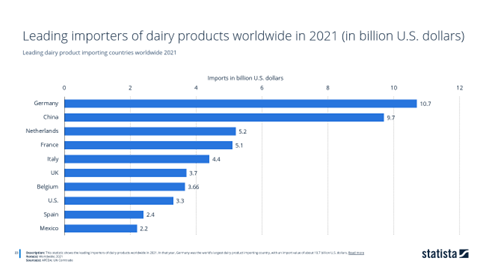

In 2021, Germany was the world’s largest dairy product importing country, with an import value of about 10.7 billion U.S. dollars.

References: Statista